estate tax changes proposed 2021

People who have large estates and who want to undertake planning to reduce their federal estate tax should do so before the end of 2021 in order to take advantage of the. November 16 2021 by admin.

The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million.

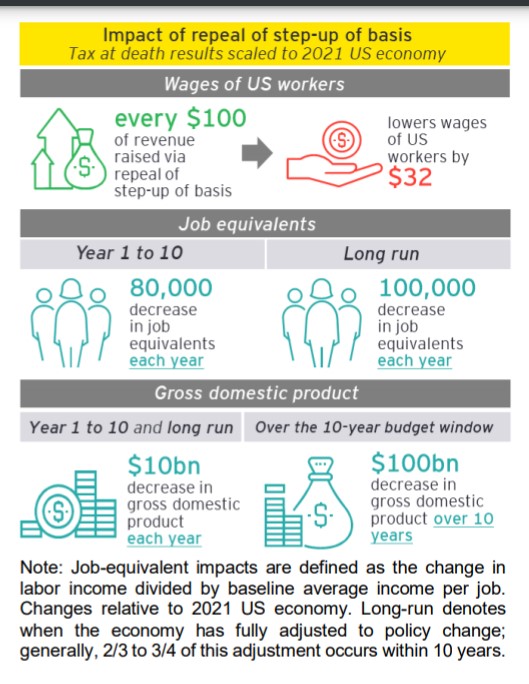

. Decrease in Exemptions on State Death Taxes. The Biden Administration has proposed significant changes to the. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

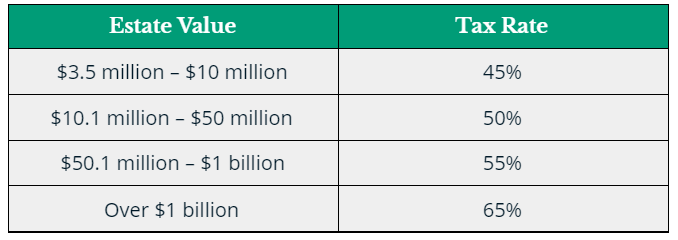

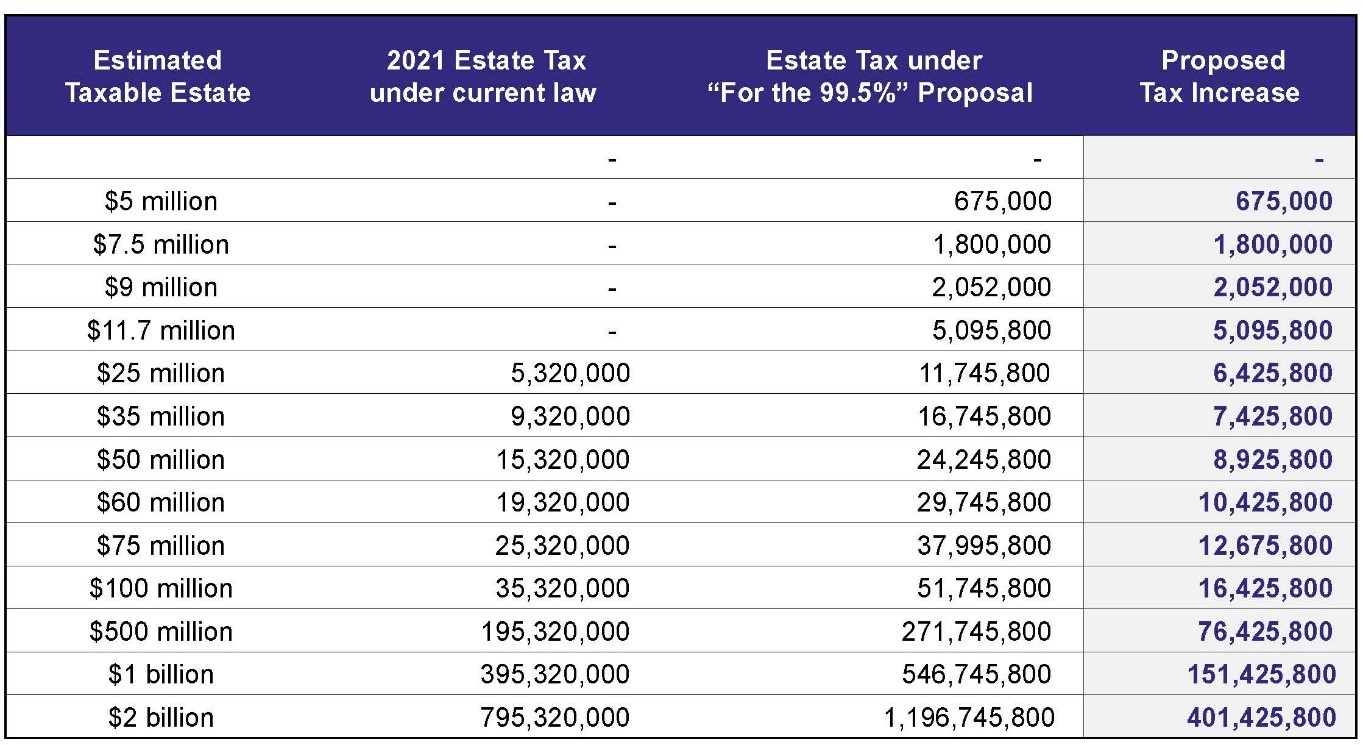

Elizabeth Warrens Ultra-Millionaire Tax Act generally includes an annual 2 tax on wealth over 50 million with a 3 tax on wealth that exceeds 1 billion. Reducing the estate and gift tax exemption to 6020000. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Reducing the Estate and Gift Tax Exemption. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

Starting with the 2006 edition the Index has measured each states business tax climate as it stands at the beginning of the standard state fiscal year July 1. This Alert focuses on the changes that directly impact common estate planning strategies. Decreased from 567 million to 4 million.

On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing multiple. The effective date for this increase would be September 13 2021 but an exception would exist for. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income.

As difficult as it may be the best approach. Under the proposed legislation the federal estate tax exemption which is the amount of ones estate that can pass free from tax at death would be sharply reduced. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

Reducing the Estate and Gift Tax Exemption. In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. As of January 1 2021 the death tax exemption in Washington DC.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. The exemption equivalent was. The current 2021 gift and estate tax exemption is 117 million for each US.

July 13 2021. So if a resident of. Decrease of Estate and Gift Tax Exemption.

As a result of the proposed tax law. If the exemption is decreased from 117 million to 35 million and the estate tax rate is raised from 40 percent to 45 percent the cost of inaction is nearly 37 million if an. On 25 August 2021 United States US Senate Finance Committee Chairman Ron Wyden and Senators Sherrod Brown and Mark Warner detailed the international tax framework they.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Estate and Gift Taxation.

Estate Tax Law Changes What To Do Now Pierrolaw

Major Tax Changes Are Coming What Lies Ahead For Estates

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Proposed Estate Tax Law Changes Pyke Associates Pc

How Uhnw Can Prep For Tax Changes Bernstein

Potential Estate Tax Law Changes To Watch In 2021

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Step Up In Basis Archives Policy And Taxation Group

How Biden S Tax Proposal Changes Could Affect Your Estate Plan

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

Prepare Clients Now For Possible Trust Estate And Gift Tax Changes Rethinking65

How To Prepare For The Biden Estate Tax Increases Alterra Advisors

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

New York S Death Tax The Case For Killing It Empire Center For Public Policy

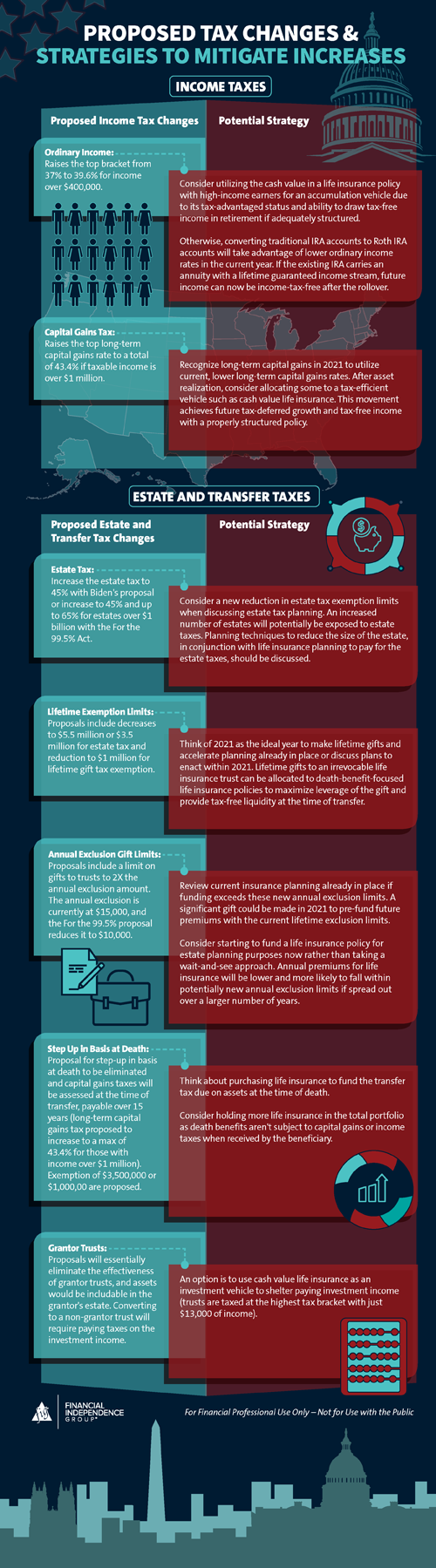

Ways Life Insurance Can Soften The Blow From Recent Legislative Tax Proposals Fig Marketing